Optimizing Returns with DeFi Lending Platforms

- Understanding DeFi Lending Platforms

- Maximizing Returns through DeFi Lending

- The Benefits of Utilizing DeFi Lending Platforms

- Strategies for Optimizing Returns in DeFi Lending

- Exploring the Risks and Rewards of DeFi Lending

- Comparing Different DeFi Lending Platforms

Understanding DeFi Lending Platforms

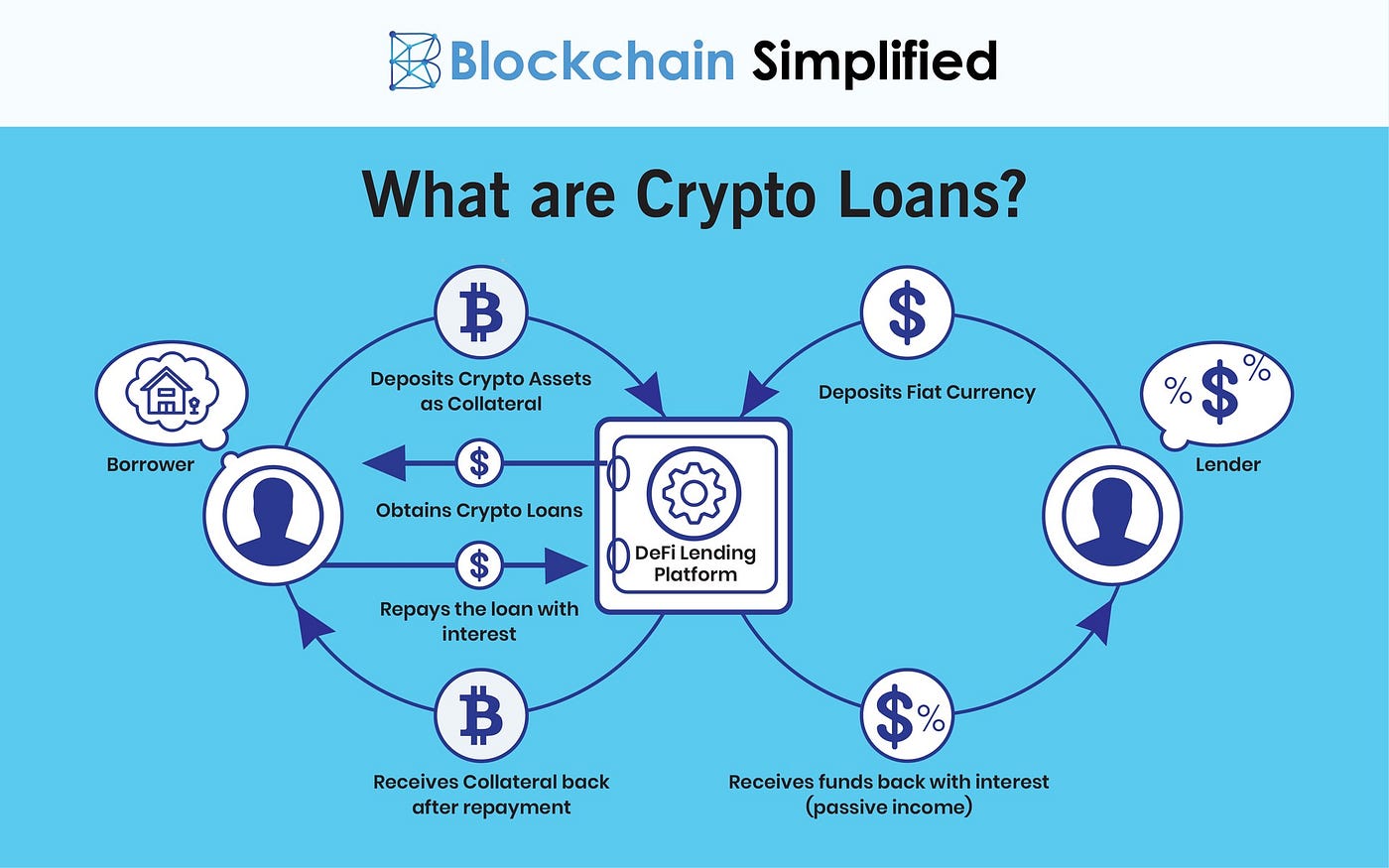

Understanding DeFi lending platforms is crucial for investors looking to optimize their returns in the cryptocurrency space. These platforms allow users to lend their digital assets to borrowers in exchange for interest payments. By participating in DeFi lending, investors can earn passive income on their crypto holdings without the need for traditional financial intermediaries.

One of the key advantages of DeFi lending platforms is the ability to earn higher interest rates compared to traditional savings accounts. This is due to the decentralized nature of these platforms, which eliminates the need for banks or other financial institutions to facilitate transactions. As a result, investors can potentially earn higher returns on their investments.

When using a DeFi lending platform, investors must understand the risks involved. While these platforms offer the potential for high returns, they also come with a higher level of risk compared to traditional investments. It is important for investors to conduct thorough research and due diligence before participating in any DeFi lending activities.

Overall, DeFi lending platforms can be a valuable tool for investors looking to optimize their returns in the cryptocurrency market. By understanding how these platforms work and the risks involved, investors can make informed decisions about where to allocate their digital assets for maximum profitability.

Maximizing Returns through DeFi Lending

Maximizing returns through decentralized finance (DeFi) lending platforms can be a lucrative strategy for investors looking to optimize their earnings. By utilizing these platforms, individuals can lend out their crypto assets to borrowers in exchange for interest payments. This process allows investors to earn passive income on their holdings while also contributing to the liquidity of the DeFi ecosystem.

One of the key advantages of DeFi lending is the ability to earn higher interest rates compared to traditional banking products. This is due to the decentralized nature of these platforms, which eliminates the need for intermediaries and allows for more competitive rates. Additionally, DeFi lending platforms often offer a wide range of assets to choose from, giving investors the flexibility to diversify their holdings and maximize their returns.

When using DeFi lending platforms, it is important to conduct thorough research and due diligence to ensure the platform is reputable and secure. Investors should also consider factors such as the platform’s interest rates, collateral requirements, and overall user experience. By carefully selecting the right DeFi lending platform, investors can optimize their returns and take advantage of the growing opportunities in the decentralized finance space.

The Benefits of Utilizing DeFi Lending Platforms

Utilizing decentralized finance (DeFi) lending platforms can offer a wide range of benefits for investors looking to optimize their returns. These platforms provide a unique opportunity to earn passive income by lending out digital assets to borrowers in exchange for interest payments. One of the key advantages of using DeFi lending platforms is the ability to earn higher yields compared to traditional savings accounts or other investment options.

Additionally, DeFi lending platforms typically operate on blockchain technology, which ensures transparency and security for all transactions. This level of trust and reliability is crucial for investors looking to maximize their returns while minimizing risks. Furthermore, DeFi lending platforms often offer a wide range of digital assets that can be used as collateral, providing flexibility and diversification for investors.

Another benefit of utilizing DeFi lending platforms is the ability to access liquidity quickly and easily. Unlike traditional lending institutions, which may have lengthy approval processes and strict requirements, DeFi platforms allow users to borrow and lend funds almost instantly. This can be particularly advantageous for investors who need access to capital for time-sensitive opportunities or emergencies.

In conclusion, DeFi lending platforms offer a compelling option for investors seeking to optimize their returns in a secure and efficient manner. By taking advantage of the benefits of these platforms, investors can potentially earn higher yields, access a wide range of digital assets, and enjoy quick and easy liquidity. Overall, DeFi lending platforms represent a valuable tool for investors looking to maximize their financial potential in the rapidly evolving world of decentralized finance.

Strategies for Optimizing Returns in DeFi Lending

When it comes to **optimizing returns** in **DeFi lending**, there are several **strategies** that **investors** can employ to **maximize** their **profits**. One **strategy** is to **diversify** your **portfolio** across multiple **lending platforms**. By **spreading** your **investments** across different **protocols**, you can **reduce** the **risk** of **loss** if one **platform** **fails**. Another **strategy** is to **take advantage** of **interest** **rate** **arbitrage**. This **involves** **borrowing** **assets** at a **low** **interest** **rate** on one **platform** and **lending** them out at a **higher** **rate** on another **platform** to **capture** the **difference** in **rates**.

Exploring the Risks and Rewards of DeFi Lending

When considering DeFi lending platforms, it is crucial to explore the risks and rewards associated with this innovative form of decentralized finance. While DeFi lending can offer high returns compared to traditional banking, it also comes with its own set of challenges.

- One of the main risks of DeFi lending is smart contract vulnerabilities. Since DeFi platforms operate on blockchain technology, any flaws in the underlying code can lead to security breaches and potential loss of funds.

- Another risk to consider is impermanent loss. This occurs when the value of the assets you have deposited fluctuates, resulting in losses when compared to simply holding the assets.

- On the other hand, the rewards of DeFi lending can be substantial. By providing liquidity to the platform, users can earn interest on their deposits, often at rates much higher than traditional savings accounts.

- Additionally, DeFi lending allows for greater financial inclusion by providing access to financial services to individuals who may not have access to traditional banking systems.

It is important for investors to carefully weigh the risks and rewards of DeFi lending before participating in these platforms. By conducting thorough research, diversifying investments, and staying informed about the latest trends in the DeFi space, individuals can optimize their chances of maximizing returns while minimizing potential losses.

Comparing Different DeFi Lending Platforms

When comparing different decentralized finance (DeFi) lending platforms, it is essential to consider various factors to optimize returns on your investments. Each platform has its unique features, interest rates, collateral requirements, and risk levels. By evaluating these aspects, you can make an informed decision on which platform aligns best with your financial goals.

- Interest Rates: One of the key factors to consider when comparing DeFi lending platforms is the interest rates offered. Higher interest rates can lead to greater returns on your investments, but they may also come with higher risks. It is crucial to strike a balance between high returns and risk management.

- Collateral Requirements: Different platforms have varying collateral requirements for borrowers. Some platforms may require borrowers to provide more collateral to access loans, while others may offer more flexibility. Understanding the collateral requirements can help you assess the risk associated with lending on a particular platform.

- Risk Levels: Assessing the risk levels of different DeFi lending platforms is crucial to protect your investments. Some platforms may have higher default rates or smart contract vulnerabilities, increasing the risk of losing your funds. Conduct thorough research on the security measures and risk management strategies implemented by each platform.

- Platform Reputation: Consider the reputation of each DeFi lending platform within the crypto community. Platforms with a strong track record of security, transparency, and user satisfaction are more likely to provide a safe and reliable lending experience. Look for reviews, audits, and community feedback to gauge the reputation of a platform.

- User Experience: The user experience offered by a DeFi lending platform can significantly impact your overall experience as a lender. Look for platforms that are user-friendly, intuitive, and provide adequate support and resources for users. A seamless user experience can enhance your ability to optimize returns on your investments.