Securing Your Crypto Investments on Exchanges

- Understanding the risks of storing your crypto on exchanges

- Best practices for securing your crypto assets on exchanges

- How to choose a secure exchange for your crypto investments

- Implementing two-factor authentication for added security

- Protecting your funds from hacking and phishing attacks

- The importance of regularly updating your security measures on exchanges

Understanding the risks of storing your crypto on exchanges

When considering where to store your cryptocurrency investments, it is crucial to understand the risks associated with keeping them on exchanges. While exchanges provide convenience and liquidity for trading, they also pose security vulnerabilities that could result in the loss of your assets. Here are some key points to consider:

- **Security Breaches:** Exchanges are prime targets for hackers due to the large amounts of digital assets they hold. In the past, several exchanges have fallen victim to security breaches, resulting in significant losses for users.

- **Regulatory Risks:** Exchanges are subject to regulatory scrutiny and changes, which could impact their operations and the safety of your funds. It is essential to stay informed about the regulatory environment in which the exchange operates.

- **Counterparty Risk:** When you store your crypto on an exchange, you are essentially trusting the exchange to safeguard your assets. If the exchange faces financial difficulties or goes bankrupt, you may lose access to your funds.

- **Lack of Control:** By storing your crypto on an exchange, you are relinquishing control of your private keys, which are essential for accessing and managing your assets. This lack of control could leave you vulnerable to unforeseen circumstances.

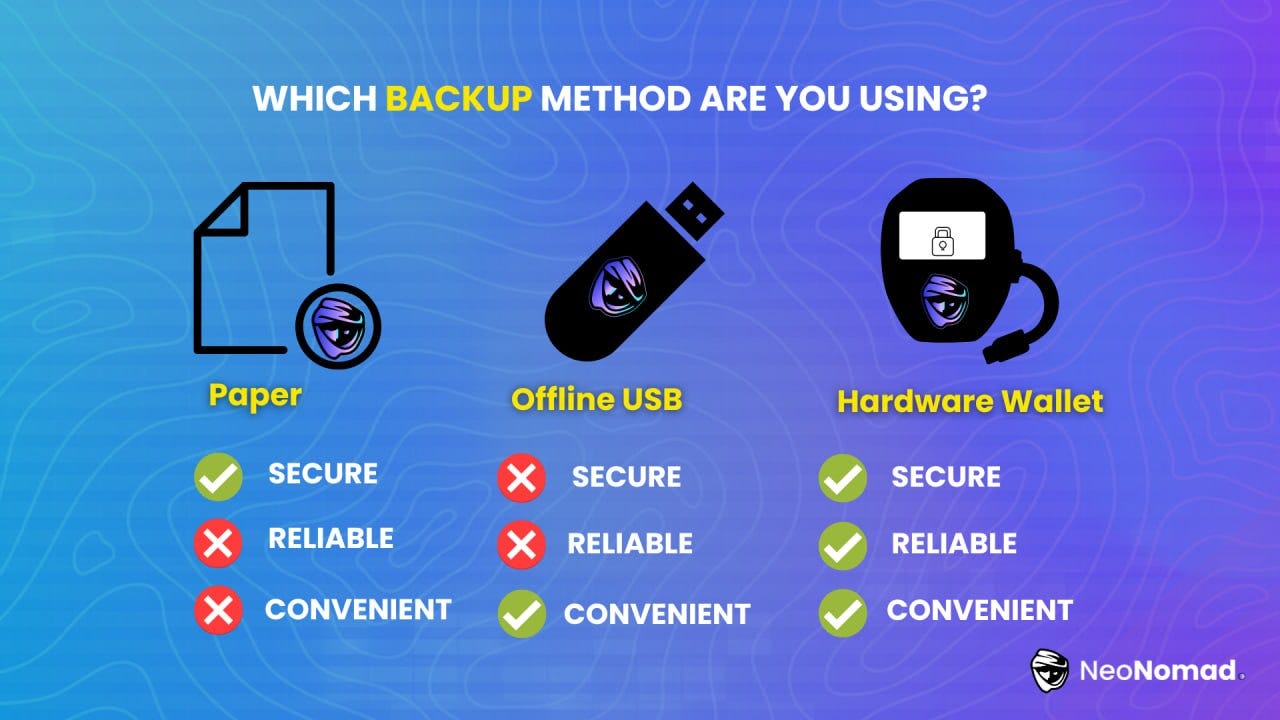

Overall, while exchanges offer convenience and liquidity, it is essential to weigh the risks involved in storing your crypto assets on them. Consider using hardware wallets or cold storage solutions for long-term storage to minimize the risks associated with exchanges.

Best practices for securing your crypto assets on exchanges

When it comes to securing your crypto assets on exchanges, there are several best practices you should follow to ensure the safety of your investments. Here are some key tips to help you protect your digital assets from potential threats:

- Enable two-factor authentication (2FA): One of the most important steps you can take to secure your crypto holdings is to enable 2FA on your exchange account. This adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone, in addition to your password.

- Use a hardware wallet: Consider storing the majority of your cryptocurrency in a hardware wallet rather than keeping it all on the exchange. Hardware wallets are considered one of the safest ways to store digital currencies as they are not connected to the internet, making them less vulnerable to hacking.

- Regularly update your security settings: Make sure to regularly review and update your security settings on the exchange platform. This includes changing your password periodically, monitoring login activity, and setting up alerts for any suspicious account activity.

- Avoid sharing sensitive information: Be cautious about sharing sensitive information, such as your account credentials or personal details, with anyone. Scammers may try to trick you into revealing this information through phishing attempts or social engineering tactics.

- Diversify your holdings: Consider diversifying your crypto portfolio across multiple exchanges to reduce the risk of losing all your assets in case one exchange is compromised. This way, even if one platform is breached, you will still have investments stored elsewhere.

By following these security measures, you can better protect your crypto assets and minimize the risk of falling victim to cyber attacks or fraudulent activities on exchanges. Remember that the safety of your digital investments is in your hands, so it’s crucial to stay vigilant and proactive in safeguarding your cryptocurrency holdings.

How to choose a secure exchange for your crypto investments

When it comes to securing your crypto investments on exchanges, choosing a secure platform is crucial. Here are some tips to help you select a reliable exchange:

- Research the exchange’s reputation and history to ensure it has a track record of security.

- Look for exchanges that offer two-factor authentication (2FA) to add an extra layer of protection to your account.

- Check if the exchange keeps the majority of its funds in cold storage to prevent hacking.

- Ensure the exchange has a strong password policy and encryption methods to safeguard your account.

- Read reviews and feedback from other users to gauge their experiences with the exchange’s security measures.

By following these guidelines, you can choose a secure exchange for your crypto investments and minimize the risk of unauthorized access to your funds.

Implementing two-factor authentication for added security

One effective way to enhance the security of your crypto investments on exchanges is by implementing two-factor authentication (2FA). This additional layer of security requires users to provide two different authentication factors before gaining access to their accounts.

By enabling 2FA, you can significantly reduce the risk of unauthorized access to your exchange account, as even if a malicious actor obtains your password, they would still need the second factor to log in successfully.

There are several types of 2FA methods available, including Google Authenticator, Authy, hardware tokens, and biometric authentication. It is recommended to choose a method that best suits your preferences and provides the highest level of security for your account.

Remember to keep your 2FA method secure and avoid sharing it with anyone. Additionally, make sure to regularly update your authentication settings and review any suspicious activity on your account to ensure the ongoing security of your crypto investments.

Protecting your funds from hacking and phishing attacks

When it comes to protecting your funds on crypto exchanges, it is crucial to be vigilant against hacking and phishing attacks. These cyber threats can result in the loss of your investments if you are not careful. Here are some tips to help you secure your crypto assets:

- Enable two-factor authentication (2FA) on your exchange account to add an extra layer of security.

- Be cautious of phishing emails that may try to trick you into revealing your login credentials. Always verify the source before clicking on any links.

- Avoid using public Wi-Fi networks when accessing your exchange account as they may not be secure.

- Regularly update your password and use a strong combination of letters, numbers, and special characters.

- Consider using a hardware wallet to store the majority of your crypto holdings offline for added security.

By following these best practices, you can protect your funds from cyber attacks and secure your crypto investments on exchanges.

The importance of regularly updating your security measures on exchanges

Regularly updating your security measures on exchanges is crucial to safeguarding your crypto investments. As the cryptocurrency market continues to evolve, so do the tactics used by hackers to exploit vulnerabilities in exchange platforms. By staying proactive and keeping your security measures up to date, you can reduce the risk of falling victim to cyber attacks.

One of the main reasons why updating your security measures is important is to protect your assets from theft. Hackers are constantly looking for ways to breach exchange platforms and steal users’ funds. By regularly updating your security measures, you can stay one step ahead of potential threats and minimize the risk of losing your investments.

Additionally, updating your security measures can help you comply with regulatory requirements. Many jurisdictions have specific guidelines for cryptocurrency exchanges to follow in order to prevent money laundering and other illegal activities. By keeping your security measures up to date, you can ensure that you are in compliance with these regulations and avoid any potential legal issues.

Furthermore, updating your security measures can also improve the overall user experience on exchange platforms. By implementing the latest security features, you can provide your users with peace of mind knowing that their funds are safe and secure. This can help build trust and loyalty among your user base, ultimately leading to increased trading volume and revenue for the exchange.

In conclusion, regularly updating your security measures on exchanges is essential for protecting your crypto investments, complying with regulations, and enhancing the user experience. By staying proactive and implementing the latest security features, you can mitigate the risk of cyber attacks and safeguard your assets in the volatile world of cryptocurrency trading.