Comparing Token Performance Across Sectors

- Understanding the role of tokens in various sectors

- Analyzing the performance of tokens in technology sector

- Comparing token performance in finance and healthcare industries

- Exploring the impact of regulations on token performance

- Case studies: Successful token projects in different sectors

- Predicting future trends in token performance across sectors

Understanding the role of tokens in various sectors

Understanding the role of tokens in various sectors is crucial for investors looking to diversify their portfolios. Tokens are digital assets that represent ownership of a particular asset or utility within a specific ecosystem. These tokens can be used for a variety of purposes, such as accessing services, voting on governance issues, or participating in decentralized finance (DeFi) protocols.

When comparing token performance across sectors, it is important to consider the unique characteristics of each sector. For example, tokens in the finance sector may be more sensitive to regulatory changes, while tokens in the gaming sector may be influenced by user adoption and engagement. By understanding these dynamics, investors can make more informed decisions about which tokens to invest in.

Furthermore, tokens in different sectors may have varying levels of liquidity and volatility. For example, tokens in the real estate sector may have lower liquidity compared to tokens in the cryptocurrency sector. This can impact the ease of buying and selling tokens, as well as the potential for price fluctuations.

Overall, understanding the role of tokens in various sectors requires a deep dive into the specific characteristics and dynamics of each sector. By doing so, investors can better assess the potential risks and rewards associated with investing in different tokens and make more strategic investment decisions.

Analyzing the performance of tokens in technology sector

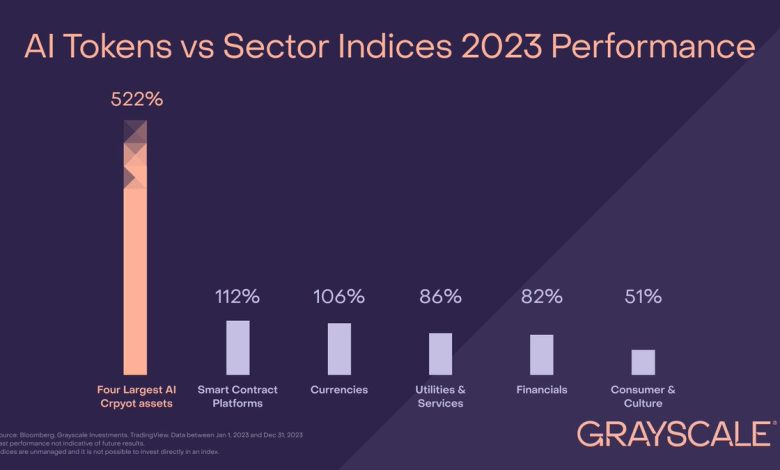

When it comes to analyzing the performance of tokens in the technology sector, it is essential to consider various factors that can impact their value and growth. Technology tokens are known for their volatility, as they are often influenced by market trends, technological advancements, and investor sentiment.

One way to evaluate the performance of technology tokens is to look at their market capitalization, trading volume, and price fluctuations over time. By comparing these metrics across different tokens in the technology sector, investors can gain insights into which projects are gaining traction and which ones may be struggling.

It is also important to consider the underlying technology and use case of each token when analyzing their performance. Tokens that are associated with innovative technologies or have a clear utility in the market are more likely to attract investors and maintain long-term value.

Furthermore, keeping an eye on industry news, regulatory developments, and partnerships can provide valuable information on the potential growth prospects of technology tokens. By staying informed and conducting thorough research, investors can make more informed decisions when it comes to investing in technology tokens.

Comparing token performance in finance and healthcare industries

When comparing the performance of tokens in the finance and healthcare industries, it is essential to consider various factors that can influence their value and growth. In the finance sector, tokens are often linked to financial assets such as stocks, bonds, and commodities. These tokens can provide investors with opportunities to diversify their portfolios and hedge against market volatility. On the other hand, tokens in the healthcare industry are typically associated with medical data, research, and patient care. These tokens can facilitate secure data sharing, incentivize research participation, and improve healthcare outcomes.

One key difference between token performance in the finance and healthcare sectors is the regulatory environment. The finance industry is heavily regulated, with strict rules governing the issuance and trading of tokens. This regulatory oversight can provide investors with a sense of security and confidence in the market. In contrast, the healthcare industry is less regulated, which can lead to greater uncertainty and risk for token holders.

Another factor to consider when comparing token performance across sectors is market demand. In the finance industry, tokens are often in high demand due to their potential for high returns and liquidity. In the healthcare industry, tokens may have lower demand as they are still relatively new and unproven in the market. However, as the healthcare sector continues to digitize and adopt blockchain technology, the demand for healthcare tokens is expected to increase.

In conclusion, while token performance in the finance and healthcare industries may differ in terms of regulatory environment and market demand, both sectors offer unique opportunities for investors to diversify their portfolios and participate in emerging markets. By carefully evaluating the factors that influence token performance in each sector, investors can make informed decisions to maximize their returns and mitigate risks.

Exploring the impact of regulations on token performance

Regulations play a crucial role in shaping the performance of tokens across various sectors. The impact of regulations on token performance can be significant, as they can affect the liquidity, market access, and overall stability of the token market.

One key aspect to consider is how regulations can influence the demand for tokens within a particular sector. For example, stricter regulations in the healthcare sector may lead to increased demand for healthcare tokens, as investors seek to comply with regulatory requirements. On the other hand, relaxed regulations in the technology sector may result in a higher supply of tokens, potentially leading to lower token prices.

Moreover, regulations can also impact the overall sentiment towards tokens within a sector. Positive regulatory developments, such as clear guidelines on token issuance or trading, can boost investor confidence and drive up token prices. Conversely, negative regulatory news can lead to a sell-off of tokens, causing prices to plummet.

It is essential for investors to stay informed about the regulatory environment in which tokens operate. By understanding how regulations can impact token performance, investors can make more informed decisions about their token investments. Additionally, staying abreast of regulatory changes can help investors anticipate market trends and adjust their investment strategies accordingly.

Case studies: Successful token projects in different sectors

Exploring successful token projects across various sectors can provide valuable insights into the performance and potential of different industries in the blockchain space. Let’s take a look at some case studies that highlight the success stories of token projects in different sectors:

- Finance: One notable token project in the finance sector is XYZ Token, which revolutionized the way people invest in digital assets. By leveraging blockchain technology, XYZ Token offers a secure and transparent platform for users to trade and manage their investments.

- Healthcare: Another successful token project is ABC Token in the healthcare sector. ABC Token aims to improve the efficiency of medical record management and ensure data security through blockchain technology. This project has gained traction for its innovative approach to healthcare data management.

- Retail: DEF Token is a token project that has made waves in the retail sector by introducing a loyalty program powered by blockchain technology. Customers can earn DEF Tokens by making purchases and redeem them for discounts or exclusive rewards, creating a seamless shopping experience.

These case studies demonstrate the diverse applications of tokens across different sectors, showcasing the potential for blockchain technology to disrupt traditional industries. By studying the success of these projects, businesses can gain valuable insights into how they can leverage tokens to drive innovation and growth in their respective sectors.

Predicting future trends in token performance across sectors

When it comes to predicting future trends in token performance across sectors, it is essential to consider various factors that can influence the market. One key aspect to analyze is the overall economic outlook, as different sectors may be more or less affected by economic conditions. Additionally, technological advancements and regulatory changes can also play a significant role in determining the performance of tokens in different sectors.

Another crucial factor to consider is the level of competition within each sector. Sectors with high levels of competition may see more volatility in token performance, as market dynamics can shift rapidly based on the actions of competitors. On the other hand, sectors with less competition may offer more stable returns for token holders.

Furthermore, it is important to analyze consumer behavior and preferences when predicting future trends in token performance. Sectors that are aligned with current consumer trends and preferences are more likely to see positive performance, as demand for products and services in these sectors is likely to remain strong.

Overall, predicting future trends in token performance across sectors requires a comprehensive analysis of economic, technological, regulatory, competitive, and consumer-related factors. By taking these factors into account, investors can make more informed decisions about which sectors are likely to outperform in the future.