Token Swaps on Decentralized Platforms

- Understanding Token Swaps and Their Importance in Decentralized Platforms

- The Evolution of Token Swaps: From Centralized Exchanges to Decentralized Platforms

- Exploring the Benefits of Token Swaps for Crypto Traders and Investors

- How Decentralized Platforms Are Revolutionizing the Token Swap Process

- Navigating the Risks and Challenges of Token Swaps on Decentralized Platforms

- The Future of Token Swaps: Trends and Innovations in Decentralized Finance

Understanding Token Swaps and Their Importance in Decentralized Platforms

Token swaps play a crucial role in decentralized platforms, facilitating the exchange of one cryptocurrency for another. This process is essential for users looking to diversify their digital asset portfolios or participate in new projects. By swapping tokens, individuals can access a wider range of investment opportunities and potentially increase their returns.

One of the key benefits of token swaps is their ability to promote liquidity within decentralized platforms. By enabling seamless exchanges between different cryptocurrencies, token swaps help maintain a healthy trading environment and ensure that users can easily buy and sell assets as needed. This liquidity is essential for the overall functionality and success of decentralized platforms.

Furthermore, token swaps can also support the growth and development of new projects within the decentralized ecosystem. By allowing users to exchange tokens issued by emerging platforms, token swaps help increase awareness and adoption of these projects. This, in turn, can attract more investors and users, ultimately contributing to the expansion of the decentralized economy.

The Evolution of Token Swaps: From Centralized Exchanges to Decentralized Platforms

Token swaps have undergone a significant evolution in recent years, transitioning from being primarily conducted on centralized exchanges to decentralized platforms. This shift has been driven by a growing demand for more secure, transparent, and efficient ways to exchange digital assets.

Decentralized platforms offer users greater control over their funds, as transactions are executed directly between peers without the need for intermediaries. This peer-to-peer model eliminates the risk of hacks or fraud that can occur on centralized exchanges. Additionally, decentralized platforms often provide lower fees and faster transaction times compared to their centralized counterparts.

One of the key innovations that have facilitated token swaps on decentralized platforms is the development of automated market makers (AMMs). These algorithms enable users to trade tokens directly from their wallets without relying on order books or matching engines. This automated process streamlines the trading experience and ensures liquidity for a wide range of assets.

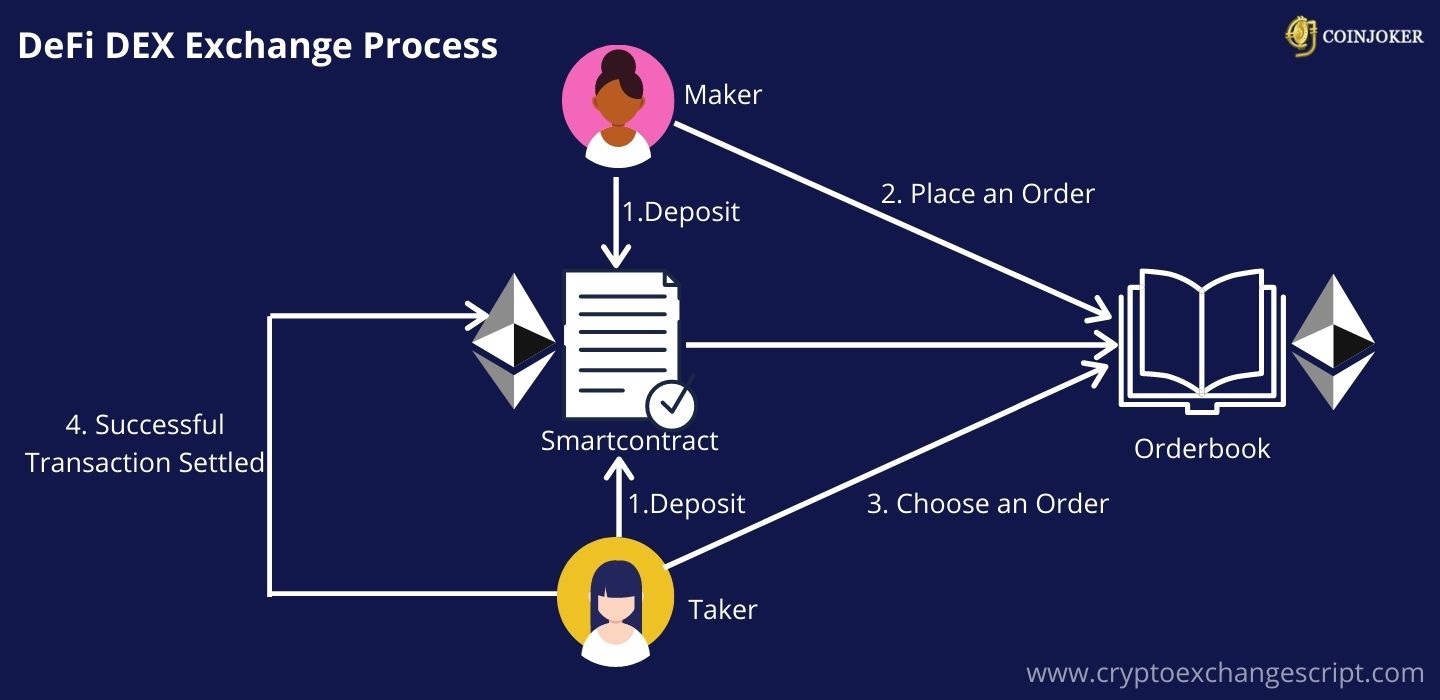

Another important development in the evolution of token swaps is the rise of decentralized exchanges (DEXs). These platforms allow users to trade tokens without the need to deposit funds into a centralized exchange, reducing the risk of losing assets in the event of a security breach. DEXs also offer a wider selection of tokens for trading, as they are not limited by the listing policies of centralized exchanges.

Overall, the shift towards decentralized platforms for token swaps represents a significant step forward in the evolution of the cryptocurrency ecosystem. By providing users with greater security, transparency, and efficiency, decentralized platforms are poised to play a central role in the future of digital asset trading.

Exploring the Benefits of Token Swaps for Crypto Traders and Investors

Token swaps on decentralized platforms offer a range of benefits for crypto traders and investors. These swaps allow individuals to exchange one type of token for another without the need for a centralized intermediary. This process is typically facilitated through smart contracts on blockchain networks, ensuring security and transparency.

One of the key advantages of token swaps is the ability to diversify one’s cryptocurrency portfolio quickly and efficiently. By exchanging tokens, traders can take advantage of new investment opportunities and reduce risk by spreading their holdings across different assets. This can help to protect against market volatility and potential losses.

Additionally, token swaps can provide access to tokens that may not be available on traditional exchanges. This opens up new possibilities for investors to participate in innovative projects and gain exposure to emerging technologies. By participating in token swaps, individuals can stay ahead of the curve and potentially capitalize on the next big trend in the crypto space.

Furthermore, token swaps can offer cost-effective solutions for trading cryptocurrencies. By eliminating the need for intermediaries, traders can avoid high fees and delays associated with traditional exchanges. This can result in significant cost savings over time, allowing investors to maximize their returns and make the most of their trading activities.

How Decentralized Platforms Are Revolutionizing the Token Swap Process

Decentralized platforms have been at the forefront of revolutionizing the token swap process. These platforms leverage blockchain technology to enable peer-to-peer token exchanges without the need for intermediaries. This not only enhances security but also increases efficiency and reduces costs associated with traditional token swaps.

One of the key advantages of decentralized platforms for token swaps is the ability to swap tokens directly between users, eliminating the need for a centralized exchange. This peer-to-peer model allows for faster transactions and greater control over assets. Additionally, decentralized platforms often offer a wider range of tokens for swapping, providing users with more options and flexibility.

Another significant benefit of decentralized platforms is the increased transparency they provide. Since transactions are recorded on the blockchain, users can easily verify the details of a token swap, ensuring trust and security. This transparency also helps to prevent fraud and manipulation, making decentralized platforms a safer option for token swaps.

Overall, decentralized platforms are transforming the token swap process by offering a more secure, efficient, and transparent way to exchange tokens. With the growing popularity of decentralized finance (DeFi), these platforms are likely to play an increasingly important role in the cryptocurrency ecosystem.

Navigating the Risks and Challenges of Token Swaps on Decentralized Platforms

When engaging in token swaps on decentralized platforms, it is crucial to be aware of the risks and challenges that may arise. These platforms offer a level of anonymity and autonomy that can be both empowering and daunting for users. One of the main risks to consider is the potential for scams and fraudulent activities. Due to the decentralized nature of these platforms, it can be difficult to verify the legitimacy of token swaps and the parties involved.

Another challenge to navigate is the lack of regulatory oversight. Without a central authority to oversee transactions, users are left to rely on their own due diligence and research. This can make it easier for bad actors to take advantage of unsuspecting individuals. It is important to thoroughly research the tokens and projects involved in a swap before proceeding.

Additionally, the technical complexities of decentralized platforms can pose challenges for users. Understanding how to interact with smart contracts, manage private keys, and navigate different blockchain networks can be intimidating for those new to the space. It is essential to educate oneself on the technical aspects of token swaps to minimize the risk of errors or loss of funds.

The Future of Token Swaps: Trends and Innovations in Decentralized Finance

The future of token swaps in decentralized finance is filled with exciting trends and innovations that are shaping the way we exchange digital assets. One of the key developments in this space is the rise of automated market makers (AMMs), which are smart contracts that enable users to trade tokens directly with a liquidity pool rather than with other users. This has significantly increased the efficiency and accessibility of token swaps, making it easier for anyone to participate in decentralized finance.

Another trend that is gaining traction in the world of token swaps is the integration of oracles, which are third-party services that provide external data to smart contracts. By incorporating oracles into decentralized platforms, users can access real-time information about token prices and other relevant data, making their trades more informed and efficient. This integration is helping to bridge the gap between decentralized and centralized finance, bringing new opportunities for users to engage with digital assets.

In addition to these trends, there are also several innovations on the horizon that promise to further revolutionize the token swap space. One such innovation is the development of cross-chain swaps, which will allow users to exchange tokens across different blockchain networks seamlessly. This will open up new possibilities for liquidity and trading opportunities, creating a more interconnected and efficient decentralized finance ecosystem.

Overall, the future of token swaps on decentralized platforms is bright, with a range of trends and innovations that are set to transform the way we exchange digital assets. By staying informed and embracing these developments, users can take advantage of the growing opportunities in decentralized finance and participate in this exciting evolution of the financial landscape.