Understanding DeFi Protocols and Their Use Cases

- Introduction to DeFi Protocols

- Exploring the World of Decentralized Finance

- Key Features of DeFi Protocols

- Use Cases of DeFi Protocols in the Financial Industry

- Challenges and Risks Associated with DeFi Protocols

- Future Trends in DeFi Protocol Development

Introduction to DeFi Protocols

Decentralized Finance (DeFi) protocols have gained significant popularity in recent years as they offer a new way to access financial services without the need for traditional intermediaries. These protocols are built on blockchain technology, allowing users to engage in various financial activities such as lending, borrowing, trading, and more in a decentralized manner.

One of the key features of DeFi protocols is their ability to operate without the need for a central authority, making them censorship-resistant and transparent. Users can interact with these protocols directly through smart contracts, which are self-executing agreements that automatically enforce the terms of a transaction.

DeFi protocols have a wide range of use cases, including providing access to financial services for the unbanked, enabling cross-border transactions, and creating new opportunities for investors to earn passive income. These protocols have also been used to create innovative financial products such as decentralized exchanges, stablecoins, and yield farming platforms.

Exploring the World of Decentralized Finance

Decentralized finance, or DeFi, is a rapidly growing sector within the cryptocurrency industry that aims to revolutionize traditional financial systems by leveraging blockchain technology. DeFi protocols are essentially smart contracts that run on blockchain networks, enabling users to access a wide range of financial services without the need for intermediaries such as banks or brokers.

One of the key advantages of DeFi protocols is their ability to provide users with greater control over their assets. By interacting directly with smart contracts, users can lend, borrow, trade, and invest in various digital assets without having to rely on centralized institutions. This not only reduces the costs associated with traditional financial services but also eliminates the need to trust third parties with sensitive financial information.

Moreover, DeFi protocols offer a high degree of transparency and security. Since all transactions are recorded on a public blockchain, users can easily verify the integrity of the system and ensure that their funds are being handled securely. Additionally, the use of smart contracts eliminates the risk of human error or manipulation, further enhancing the overall security of the DeFi ecosystem.

In recent years, DeFi protocols have gained significant traction in the cryptocurrency community, with a wide range of use cases emerging across various sectors. From decentralized exchanges and lending platforms to prediction markets and insurance services, the potential applications of DeFi are virtually limitless. As more developers and users flock to the DeFi space, we can expect to see even more innovative solutions that challenge the status quo of traditional finance.

Key Features of DeFi Protocols

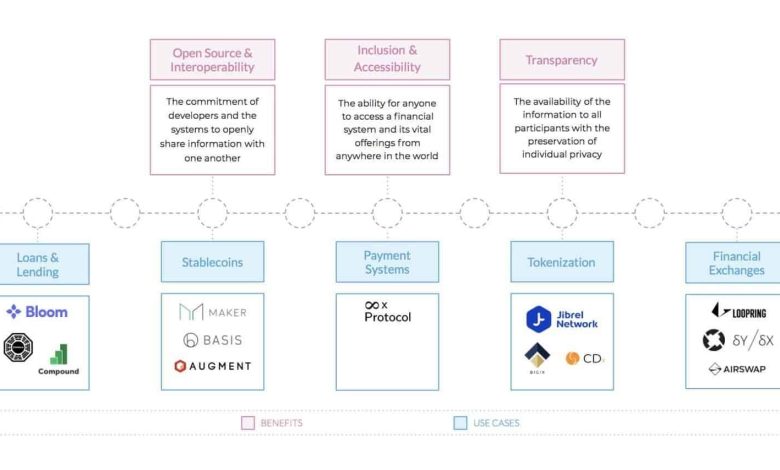

When it comes to DeFi protocols, there are several key features that set them apart from traditional financial systems. These features include:

- Decentralization: DeFi protocols operate on blockchain technology, which means they are decentralized and do not rely on a central authority to function.

- Transparency: Transactions on DeFi protocols are transparent and can be viewed by anyone on the blockchain, ensuring trust and accountability.

- Interoperability: DeFi protocols are designed to work seamlessly with other protocols and applications, allowing for greater flexibility and innovation in the ecosystem.

- Programmability: Smart contracts are at the core of DeFi protocols, enabling developers to create custom financial applications and automate processes.

- Accessibility: DeFi protocols are open to anyone with an internet connection, providing financial services to individuals who may not have access to traditional banking systems.

These key features make DeFi protocols a powerful tool for revolutionizing the financial industry and creating a more inclusive and efficient global economy.

Use Cases of DeFi Protocols in the Financial Industry

DeFi protocols have a wide range of use cases in the financial industry, offering innovative solutions to traditional financial services. One of the key use cases is decentralized lending, where users can borrow and lend assets without the need for intermediaries. This allows for more efficient and cost-effective lending processes, as well as greater accessibility to financial services for individuals who may not have access to traditional banking systems.

Another important use case of DeFi protocols is decentralized exchanges, which enable users to trade assets directly with one another without relying on a centralized exchange. This not only reduces the risk of hacking and fraud associated with centralized exchanges but also provides users with more control over their assets and trading activities.

Furthermore, DeFi protocols are also being used for decentralized asset management, allowing users to create and manage investment portfolios without the need for a traditional asset manager. This gives users more autonomy and transparency in managing their investments, as well as potentially higher returns due to lower fees and greater flexibility in investment strategies.

Challenges and Risks Associated with DeFi Protocols

When utilizing DeFi protocols, it is essential to be aware of the challenges and risks associated with them. While DeFi offers numerous benefits such as decentralization and transparency, there are also potential pitfalls that users should consider.

- Smart contract risk: DeFi protocols rely heavily on smart contracts, which are susceptible to bugs and vulnerabilities. If a smart contract is compromised, it can result in financial losses for users.

- Market volatility: The cryptocurrency market is known for its extreme volatility. Fluctuations in the market can impact the value of assets held in DeFi protocols, leading to potential losses.

- Regulatory uncertainty: The regulatory landscape surrounding DeFi is still evolving. Users may face legal challenges or restrictions as governments around the world work to understand and regulate this emerging technology.

- Security concerns: DeFi platforms are often targeted by hackers due to the potential for large financial gains. Users must take precautions to secure their assets and personal information.

- Liquidity risks: Some DeFi protocols may suffer from liquidity issues, making it difficult for users to buy or sell assets at fair prices. This can result in slippage and increased transaction costs.

It is crucial for users to conduct thorough research and due diligence before participating in DeFi protocols. By understanding the challenges and risks involved, individuals can make informed decisions to protect their investments and navigate the rapidly changing landscape of decentralized finance.

Future Trends in DeFi Protocol Development

Looking ahead, the future of DeFi protocol development is promising, with several trends shaping the landscape of decentralized finance. One key trend is the rise of interoperability between different DeFi protocols, allowing for seamless integration and communication between various platforms. This interoperability will enable users to access a wider range of financial services and products, ultimately enhancing the overall DeFi ecosystem.

Another trend to watch is the increasing focus on security and risk management within DeFi protocols. As the industry continues to grow, developers are placing a greater emphasis on building robust security measures to protect user funds and data. This heightened focus on security will help to mitigate the risks associated with using DeFi platforms and enhance user trust in the ecosystem.

Furthermore, we can expect to see continued innovation in DeFi protocol design, with developers exploring new ways to optimize efficiency and scalability. This innovation may involve the integration of advanced technologies such as artificial intelligence and machine learning to automate processes and improve user experience. By pushing the boundaries of what is possible with DeFi protocols, developers can unlock new opportunities for financial inclusion and innovation.