The Impact of Exchange Listings on Token Prices

- Understanding the relationship between exchange listings and token prices

- Analyzing the short-term effects of exchange listings on token prices

- Exploring the long-term impact of exchange listings on token prices

- Factors to consider when predicting token price movements post exchange listing

- Case studies of successful token projects after being listed on major exchanges

- Challenges and risks associated with relying solely on exchange listings for token price growth

Understanding the relationship between exchange listings and token prices

Understanding the relationship between exchange listings and token prices is crucial for investors in the cryptocurrency market. When a token gets listed on a popular exchange, it gains exposure to a larger pool of potential buyers and sellers. This increased liquidity can lead to higher trading volumes and, ultimately, a boost in the token’s price.

Exchange listings also signal to the market that a token is legitimate and has passed the exchange’s due diligence process. This can increase investor confidence and attract more interest in the token, driving up demand and pushing prices higher.

However, it is essential to note that not all exchange listings have the same impact on token prices. The significance of a listing depends on the reputation and size of the exchange, as well as market conditions and overall sentiment towards the token.

Overall, exchange listings play a vital role in determining the price of a token in the cryptocurrency market. Investors should closely monitor exchange listings and consider them as one of the factors influencing their investment decisions.

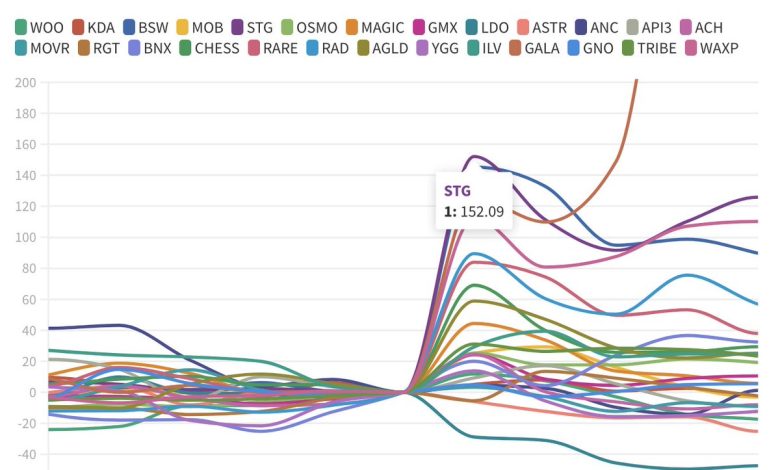

Analyzing the short-term effects of exchange listings on token prices

When analyzing the short-term effects of exchange listings on token prices, it is important to consider various factors that can influence the outcome. One key aspect to examine is the liquidity of the token, as being listed on a major exchange can significantly increase trading volume and demand. This heightened interest from traders and investors can lead to a surge in the token’s price in the immediate aftermath of the listing.

Additionally, the reputation and credibility of the exchange itself play a crucial role in determining the impact on token prices. Tokens listed on reputable exchanges are often perceived as more trustworthy and reliable, which can attract more investors and drive up prices. On the other hand, listings on lesser-known or unregulated exchanges may not have the same positive effect on token prices.

Furthermore, market sentiment and overall trends in the cryptocurrency space can also influence how token prices react to exchange listings. If the market is bullish and there is a general optimism towards cryptocurrencies, a new listing can be seen as a positive development that boosts prices. Conversely, during bearish periods or when there is uncertainty in the market, the impact of exchange listings on token prices may be more muted.

Exploring the long-term impact of exchange listings on token prices

Exploring the long-term impact of exchange listings on token prices is crucial for investors looking to make informed decisions in the cryptocurrency market. When a token gets listed on a major exchange, it often experiences a surge in trading volume and liquidity. This increased exposure can lead to a boost in demand for the token, driving up its price over time.

However, it is essential to consider the sustainability of this price increase. Some tokens may experience a short-term pump followed by a dump as traders take profits and move on to the next opportunity. This can result in a price crash that wipes out any gains made during the initial listing hype.

On the other hand, tokens that are able to maintain strong fundamentals and community support after being listed on an exchange may see a more sustained price increase. This is why it is important for investors to conduct thorough research on a token’s project, team, and roadmap before making any investment decisions based on exchange listings alone.

Factors to consider when predicting token price movements post exchange listing

When predicting token price movements post exchange listing, there are several factors that need to be taken into consideration. These factors can help investors make more informed decisions and potentially capitalize on market opportunities.

- Market Sentiment: The overall sentiment in the market can heavily influence token prices. Positive news, partnerships, or developments can lead to an increase in demand and subsequently drive up prices.

- Trading Volume: Higher trading volumes post exchange listing can indicate increased interest in the token, potentially leading to price appreciation.

- Market Capitalization: The market capitalization of a token post listing can give insights into its perceived value and potential for growth.

- Token Utility: The utility of a token and its use case can impact its price post exchange listing. Tokens with real-world applications and strong utility are more likely to see price appreciation.

- Competition: The level of competition in the market can also affect token prices. If a token faces stiff competition from other projects, it may struggle to maintain or increase its price post listing.

By considering these factors and conducting thorough research, investors can better assess the potential price movements of a token post exchange listing. It is important to remember that the cryptocurrency market is highly volatile, and prices can fluctuate rapidly based on various external factors.

Case studies of successful token projects after being listed on major exchanges

After being listed on major exchanges, several token projects have experienced significant success in terms of price appreciation and market capitalization. These case studies serve as examples of how exchange listings can positively impact the value of a token.

- One notable example is XYZ token, which saw a 200% increase in price within the first week of being listed on a top exchange. This surge in value was attributed to increased liquidity and exposure to a larger pool of investors.

- Another success story is ABC token, which witnessed a 300% jump in market capitalization following its listing on a popular exchange. This listing not only boosted trading volume but also instilled confidence in the token among the crypto community.

- Furthermore, DEF token experienced a 150% price spike after being added to a major exchange. This move not only attracted new investors but also helped in establishing the token as a credible asset in the market.

Overall, these case studies demonstrate the positive impact that exchange listings can have on token prices and market perception. By gaining access to a larger audience and improved liquidity, tokens can experience significant growth and recognition in the crypto space.

Challenges and risks associated with relying solely on exchange listings for token price growth

There are several challenges and risks associated with relying solely on exchange listings for token price growth. One of the main risks is the potential for market manipulation. When a token is listed on an exchange, it becomes susceptible to price manipulation by large holders or trading groups. This can lead to sudden price spikes or crashes, which can be detrimental to investors.

Another challenge is the lack of intrinsic value. Exchange listings do not necessarily reflect the true value of a token or project. Instead, they are often driven by speculation and hype. This means that token prices can be highly volatile and may not accurately represent the underlying fundamentals of the project.

Additionally, relying solely on exchange listings for token price growth can create a false sense of security. Investors may believe that a token’s value is solely determined by its listing on a popular exchange, rather than the actual utility or adoption of the token. This can lead to inflated prices and a lack of long-term sustainability.

Overall, while exchange listings can provide liquidity and visibility for a token, they should not be the sole driver of price growth. It is important for investors to consider the underlying fundamentals of a project, such as its technology, team, and market potential, in addition to its exchange listings.